Improve your finances

One of the biggest reasons people don’t invest is due to not having a good grasp of their personal finances.

Not understanding your finances means you don’t know what you can afford to invest. Ideally, you want to be in a situation where when things get a bit tighter financially, you’re not tempted to cash in your investments.

Taking time to understand your finances will really help you understand where you can fix some leaky buckets and find ways to free up some cash monthly to invest. You may also be surprised to learn how much you spend on certain things – fast fashion, eating out/fast food delivery orders, and Amazon purchases are common expenses that add up without realising. A quick review of your spending habits will surprise you!

Building wealth is not about your income. Building wealth is about your ability to live below your means and build financial resilience. By spending less than you earn each month allows you to build up a sum of money to cover for any unexpected bills such as a parking ticket or a high phone bill. The habit of spending more than you earn via credit cards and buy-now-pay-later companies will make you a slave to money as you end up chasing your shadow.

As Morgan Housel puts it “Financial success is not a hard science. It’s a soft skill, where how you behave is more important than what you know.”

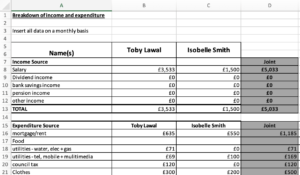

The first thing to do to get a better grasp of your finances is to understand your income and expenses. This can be done by looking at your bank statements and recording your activity in a spreadsheet. We have one which you can download in our product section [link].

If your expenses are more than your income you’ll need to work out where you can reduce how much you spend and remove some costs. There could be a subscription you don’t need or reducing some of your regular costs such as minimising your Deliveroo orders.

You don’t have to change your lifestyle to save money. At time of writing, an individual Spotify premium membership is £9.99. There is a duo plan (up to two accounts) and family plan (up to six accounts) you can get costing £13.99 and £16.99. You’ll still get the same service and product but just at a cheaper price. Straight away you can start to see how you can bring your costs down, imagine doing this across all your expenses?

Living costs are usually a huge drain on income. You can save hundreds of pounds a year shopping around for better deals. Subscribing to the Money Saving Expert (MSE) newsletter for tips will steer you in the right direction. If you have any debt on credit cards you can move these over to a 0% balance transfer card so you are only paying the balance you actually owe the credit company rather than the balance plus interest. These are the kind of tips you can expect from the MSE weekly newsletter.

Managing your finances is the first step to building wealth. You then need to be able to set a budget each month and try your very best to stick to it.

This process may seem really involved but a process that should reduce the likelihood of you ending up in debt. Lastly, once you have a good grasp of your financial health, you can then start employing your money to work for you by investing to secure your financial future.

In summary, by improving your finances and reducing your outgoings you may be able to use any savings to pay off debts, money towards your next holiday, build an emergency fund or to even invest. Being resilient (financially) is key to building generational wealth as you are able to weather most storms and improve your financial health.

Leave a Reply

Want to join the discussion?Feel free to contribute!