Financial Independence – One Step At a Time

The wealth journey is different for everyone.

Financial independence specifically, and growing wealth more generally, is a journey; like all journeys, it starts with a single step. Not many people would think/plan to sprint a marathon, even first-time marathon runners know you need to pace yourself properly, endurance is just as important as speed! If running isn’t your thing, think of building a wall – as Will Smith put it “Remember, don’t try to build the greatest wall that’s ever been built. Focus on laying a single, expertly-placed brick. Then keep doing that, every day.”

The point here is that building wealth takes time.

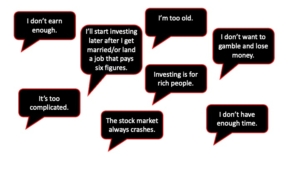

We’ve lost count of the number of excuses we’ve heard as to why people don’t invest, and by invest we mean buying assets that they think will grow in value of time (stocks and shares, property, art etc). Below are some of the excuses (mostly related to stocks and shares), which are often grounded in a lack of financial education/literacy:

What is interesting is that many of the providers of these excuses have, or are willing to invest into cryptocurrencies, or other similar schemes/products, including some crypto-related pyramid schemes – those that seemingly guarantee quick returns, or a shortcut to a lifetime of riches (many of which turn end up being scams). This isn’t a crypto-bashing blog; however, what this highlights to us is that the real reason which underpins many of the aforementioned excuses is impatience.

Know that If you’re serious about building generational wealth, the journey you’re about to embark on most likely won’t be finished by you, so stop worrying about finishing the race, the important point is to get started!

Although we favour stock market investing, we do not discourage any other form of asset investing, we encourage all forms of investing. However, in specific reference to stocks, one of Warren Buffet’s many famous quotes is “The stock market is a device for transferring money from the impatient to the patient.” Despite the risks that come with all forms of investing (i.e not knowing what the future will bring), the beauty of investing in the stock market is that you don’t need much to get started. There are so many services and products aimed at new investors and thanks to technological advancements, at its simplest, all you need is an internet connection and as little as £50 to start investing – you’ll need commitment and discipline too, but that’s not the focus of this blog!

This helps to establish sustainable habits that will benefit us in the future. We found that treating investing like we were paying a bill or a subscription, helped us to change our mindset. Our course “Mindset Matters/Stay in your lane” explores this in more detail and includes information on:

- Why it’s important to invest?

- Costs of not investing

- Budgeting

- Setting investment goals

- Staying focused for the long term

- How to get started

A successful marathon runner will tell you that the secret behind the success is in the training, waking up everyday to run further than the day before (notice we didn’t say quicker), any bricklayer will focus on one row at a time. Anyone truly committed to losing weight will assess the lifestyle change that needs to take place and that can start with the sacrifice of a single meal. Anyone truly committed to achieving anything in life has to take action. If you’re reading this and you’re yet to start your investing journey. Now is the time!

Leave a Reply

Want to join the discussion?Feel free to contribute!